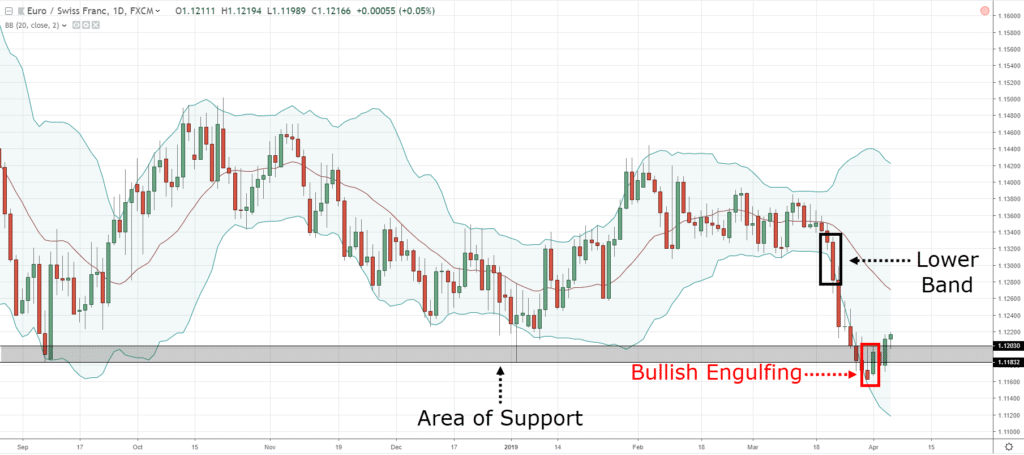

For validation, many characteristics appear at the same safety in different time frames. The TTM Squeeze pointers apply to a wide range of timeframes. If a squeeze occurs and the bars are blue (increasing and above the zero lines), he sells when two brighter blue bars (above the zero lines and decreasing) appear in succession.

For example, when you have two bars of the latest color, Carter suggests selling. The motion histogram can be utilized to pinpoint specific exit sites as well. Once the histogram reverses its orientation and begins to fall rear towards the zero lines, it’s time to sell. A poorer bar than the preceding bar is a darker color (darker red or darker blue ), while a more advanced bar than the prior bar is a lighter color (lighter red or light blue). Blue bars appear beyond the zero lines, whereas red bars appear under the zero line. The motion bars are color-coded to make them easier to understand. If the momentum is beyond and rising the zero lines (light blue slabs), purchase long if the momentum is falling and short under the zero lines (dark red bars). The motion histogram aids in determining which direction to trade. The Squeeze dots show when volatility circumstances are favorable for buying the motion histogram suggests whether to trade long or short. Interpretationīoth momentum and volatility are included in a TTM Squeeze indicator. The values of the motion histogram indicate how much below or above the average the deal is likely to move. Although the method for linear reversion is outside the choice of this essay, it effectively seeks out the “best fit” line given the feasible information. This histogram wavers near the zero lines rising momentum beyond the zero lines indicates a buying opportunity while decreasing momentum under the zero lines indicates a selling opportunity.įinally, smooth the delta price using linear regression. When the TTM Squeeze pointer fires, it also utilizes a motion oscillator to display the expected path of the move.

Minor points on the zero lines of the pointer indicate whether the squeeze is on or off: red dots show that the congestion is on, and green dots show that the congestion is off. The squeeze is considered to have “fired” when the Bollinger Bands move back and enlarge outdoors of the Keltner Channel prices are probable to break out of that close-fitting trading choice in one path or the other as volatility rises. If the overall trend is bearish and the histogram is red, SELL order can be made. If the overall trend is bullish and the histogram shows green color, a BUY order can be made. TTM squeeze indicator you can use as an excellent signal for a pullback.

0 kommentar(er)

0 kommentar(er)